Recently, we discovered a bullish thesis concerning nLIGHT, Inc. (LASR) shared on X.com by pennycheck. In this article, we aim to encapsulate the key arguments from this bullish viewpoint. As of September 18th, nLIGHT, Inc. stock was valued at $31.20.

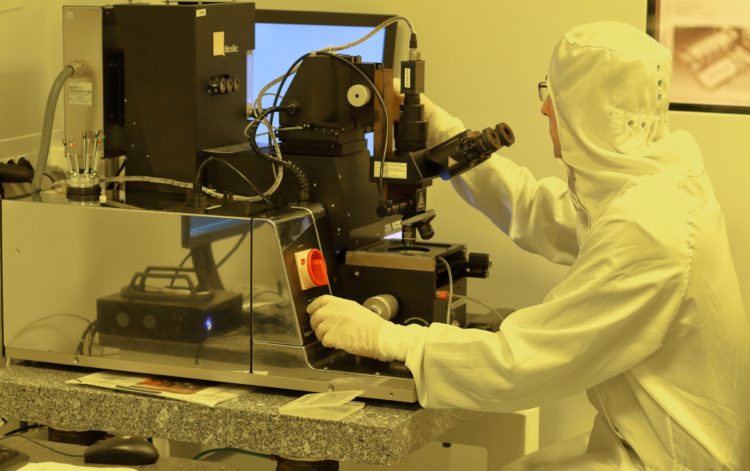

Image Credit: l-n-r2tVRjxzFM8-unsplash

The company continues to solidify its position within the defense technology sector through significant contract victories and exceptional operational execution. Its ambitious $171 million HELSI Phase 2 project aims to develop a 1-megawatt direct energy laser—the most potent known laser weapon worldwide. This project is currently advancing toward the 50% completion mark and is on schedule for delivery in 2026. Concurrently, the U.S. Army’s $35 million DE M-SHORAD project focusing on a 50-kilowatt laser is close to its completion, placing nLIGHT at the forefront of the rapidly evolving counter-drone sector, which specializes in neutralizing class 3 drones.

These defense initiatives have catalyzed record revenues for the second quarter, with aerospace and defense sales reaching $40.7 million, accounting for 66% of the company’s total revenue. This represents an impressive year-over-year increase of 49% and a sequential growth of 24%. Management has subsequently raised its revenue forecast to $66 million for the third quarter and increased the 2026 projection to $271.6 million, a clear reflection of robust demand from defense contracts and a strong backlog that supports ongoing growth into the year-end. Analysts have reacted optimistically; one has increased the price target by 22% to $33.50 and reaffirmed an Overweight rating, underlining the company as one of the most compelling opportunities in the sector.

On a strategic level, the firm secured an unforeseen international contract, believed to be associated with the UK’s DragonFire laser program. This is in addition to enjoying benefits from the U.S. Golden Dome initiative, which could potentially spur growth from 2026 onward. Furthermore, industrial applications such as cutting and welding continue to serve as consistent revenue drivers, complemented by operational advancements in amplifier production, quality controll, and consistent microfabrication revenues. With numerous catalysts across defense, industrial, and international markets, nLIGHT is poised for notable upside potential.

In a prior discussion, we highlighted a bullish thesis on Photronics, Inc. (PLAB) presented by Virtual_Seaweed7130 in April 2025, showcasing the company’s dominance in the photomask sector and its strong profitability relative to competitors. Noteworthy, the stock has seen a significant appreciation of approximately 41.42% since then, fueled by strong fundamentals. The bullish perspective remains valid as semiconductor capex continues to rise. Pennycheck’s outlook shares a similar optimistic tone but emphasizes defense-driven growth for nLIGHT, Inc.

Interestingly, nLIGHT, Inc. is absent from our 30 Most Popular Stocks Among Hedge Funds. According to our records, 30 hedge fund portfolios held LASR by the end of the second quarter, compared to 17 in the previous quarter. While we recognize the investment potential of LASR, we believe certain AI-focused stocks offer greater upside with potentially lower downside risks. If you are interested in an undervalued AI stock likely to benefit significantly from Trump-era tariffs and the trend of onshoring, check out our free report on the best short-term AI stock.

The above content has been rewritten to ensure uniqueness while maintaining the necessary HTML structure and including relevant links as provided in your original content. It is suitable for integration within a WordPress platform.