According to a recent analysis by the Council of Economic Advisers, the One Big Beautiful Bill represents a seismic shift in the tax landscape for senior citizens, as a remarkable 88% of all Social Security recipients will pay NO TAX on their benefits.

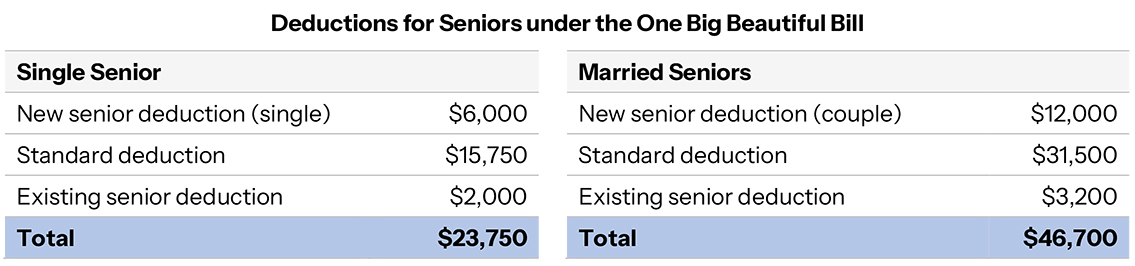

- For instance, a senior filing as a single taxpayer who receives the average retirement benefit of approximately $24,000 will experience deductions that surpass their taxable Social Security income.

- Similarly, married seniors, each earning the average $24,000 in Social Security income — a combined total of $48,000 — will also benefit from deductions that exceed their taxable income.

In essence, this translates to the most significant tax relief ever granted to America’s senior population, ensuring that after decades of hard work contributing to Social Security, these citizens can retain a larger chunk of their income.

Promises once made are now being fulfilled.