In the 1970s, the balance of power in the Middle East was firmly held by the Saudi and Iranian monarchies, alongside Israel, which were pillars of US dominance in the region. However, a seismic shift was about to occur that would shatter the status quo and reshape the geopolitical landscape.

Adam Hanieh, in his book “Crude Capitalism,” delves into the intricate web of economic relationships and financial systems that underpinned US control over oil revenues. In the 1960s, oil-producing nations, led by Venezuela, demanded changes in oil pricing that disadvantaged US oil companies. In response, the US altered tax rules to ensure continued profits for the largest oil corporations while appeasing the demands of the Saudi monarchy for a larger share of the oil wealth.

The 1970s brought about a series of price shocks that shattered the monopolistic pricing system, leading to a quadrupling of oil prices in 1973-74 and another doubling in 1979. OPEC, coordinated action by oil-producing nations, wrested control of prices from multinational companies, leading to a significant redistribution of oil wealth to the Gulf states.

The flow of “petro dollars” into the Gulf states fueled the expansion of international money markets and globalization, bolstering the US dollar as a reserve currency. This influx of wealth had far-reaching implications, shaping financialization and neoliberal economic policies.

Fast forward to the present day, and the Gulf states continue to amass staggering amounts of current account surplus, underscoring the enduring influence of oil wealth in the global financial system. The transformation of “petro dollars” into “euro dollars” further solidified the dollar’s status as a dominant reserve currency.

Hanieh’s analysis extends beyond the economic realm, delving into the geopolitical ramifications of oil wealth. The control of oil’s wealth, he argues, is a critical aspect of imperial power and influence. This control extends beyond territorial dominance to encompass financial institutions, trading houses, and global financial centers.

The intertwining of wealth, power, and terror in the global oil economy is a complex and multifaceted phenomenon. The narrative of wars fought over oil is often oversimplified; in reality, conflicts are often driven by the need to protect oil-producing nations and ensure the flow of oil.

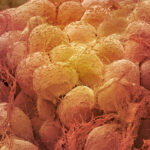

The petrochemical industry emerges as a key player in the oil economy, utilizing oil as a raw material for a wide range of products. The proliferation of synthetic materials has transformed consumer markets and industrial practices, reshaping our relationship with nature.

As the world grapples with the urgent need to transition away from fossil fuels, the role of the petrochemical industry and its environmental impact cannot be understated. The shift towards “net zero” solutions and techno-fixes by oil companies underscores the challenges of decoupling from the fossil fuel economy.

In conclusion, Hanieh’s exploration of the oil economy sheds light on the intricate web of power, wealth, and environmental degradation that underpins the global oil market. As we confront the pressing need for a sustainable energy transition, understanding the complex interplay of economic, political, and environmental factors is essential.