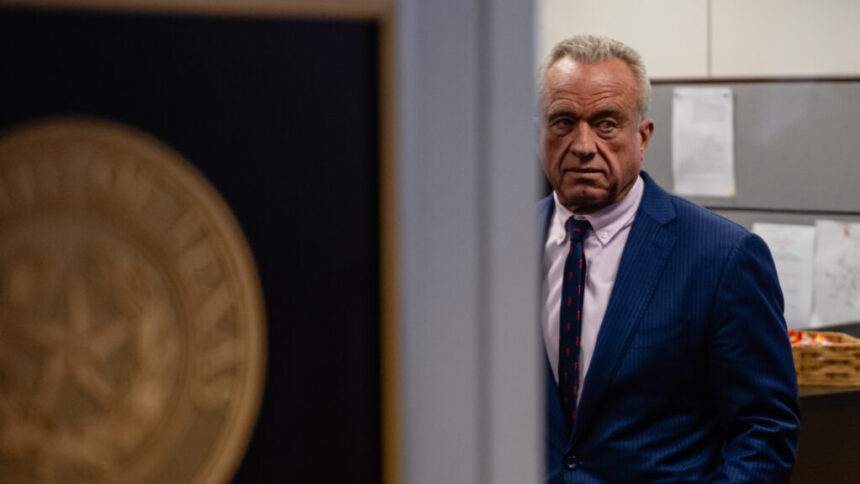

President Trump’s nominee to lead the Department of Health and Human Services, Robert F. Kennedy Jr., has made significant investments in gene-editing technology and is owed substantial advances for several books, according to financial disclosures released ahead of his confirmation hearings. These disclosures offer a comprehensive look at RFK Jr.’s financial interests, employment, and potential conflicts of interest, shedding light on his plans to divest stock holdings and step down from certain roles.

The financial disclosures show that Kennedy intends to divest his stock holdings, including stakes in biotech firms such as CRISPR Therapeutics AG and Dragonfly Therapeutics. Additionally, he will be stepping down from his roles at his law firm and at the anti-vaccine nonprofit organization Children’s Health Defense. These moves are aimed at mitigating any potential conflicts of interest that may arise from his investments and affiliations.

Kennedy’s nomination to lead the health department came after he ended his presidential campaign and endorsed President Trump. Confirmation hearings for his appointment have not yet been scheduled, but his financial disclosures provide valuable insights into his financial holdings and commitments.

It is important to note that the article referenced a restricted content section that is exclusive to STAT+ subscribers. To access the full article and in-depth analysis, newsletters, premium events, and news alerts, readers are encouraged to subscribe to STAT+. By subscribing, readers can unlock valuable information and stay informed about important developments in the healthcare industry.

In conclusion, Robert F. Kennedy Jr.’s financial disclosures offer a glimpse into his investments and potential conflicts of interest as he prepares for confirmation hearings to lead the Department of Health and Human Services. His decision to divest from certain holdings and step down from specific roles demonstrates his commitment to transparency and ethical governance in his new role.