There is a growing concern every year about the lack of “real” money skills being taught in schools, particularly when it comes to topics like filing taxes. As students progress through high school, they will inevitably encounter the task of filing taxes, yet there is often limited time dedicated to teaching them about this important aspect of financial responsibility.

Fortunately, a FREE Solution to Learn About Taxes is Available!

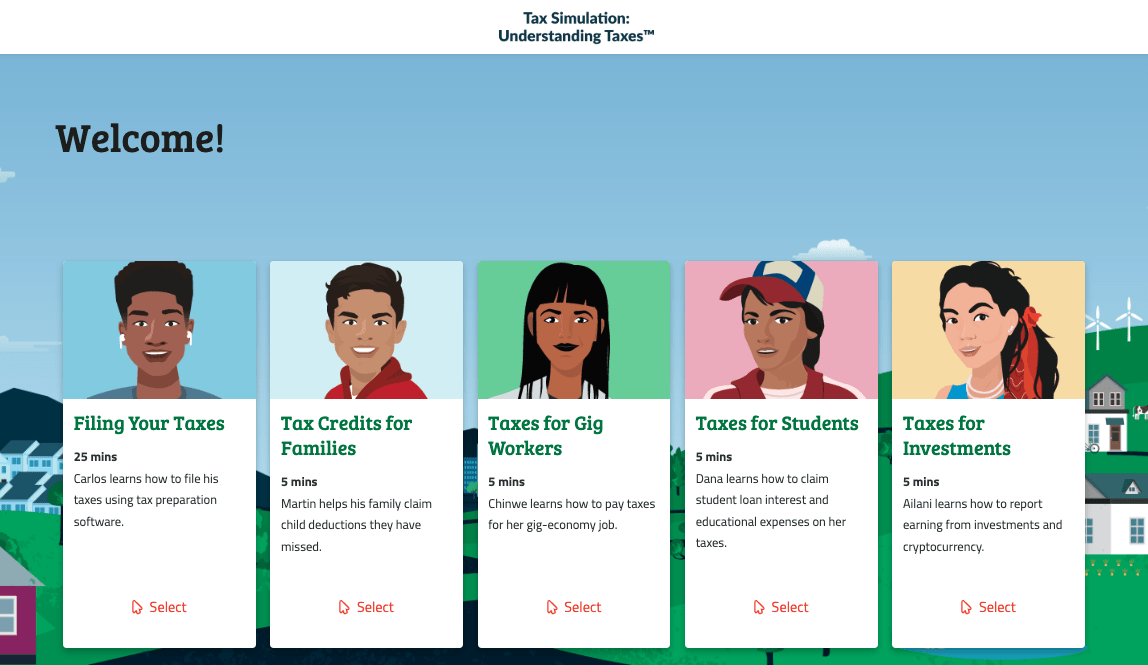

EVERFI®, in collaboration with Intuit for Education, has developed an engaging digital course called Tax Simulation: Understanding TaxesTM for high school students. This course aims to enhance financial literacy and confidence by familiarizing students with the tax process and terminology, preparing them for their financial futures. Available in both English and Spanish, this tax curriculum is completely free for educators and students to access.

No Tax Expertise Required to Utilize this Free Tax Course

Despite the complexities surrounding taxes, teachers do not need to be tax experts themselves to implement this course. With a range of teacher resources provided, addressing key topics and student inquiries becomes seamless without extensive preparation. Additionally, a parent discussion guide is available to extend the learning experience beyond the classroom.

Engaging Learning Through Empathy and Interaction

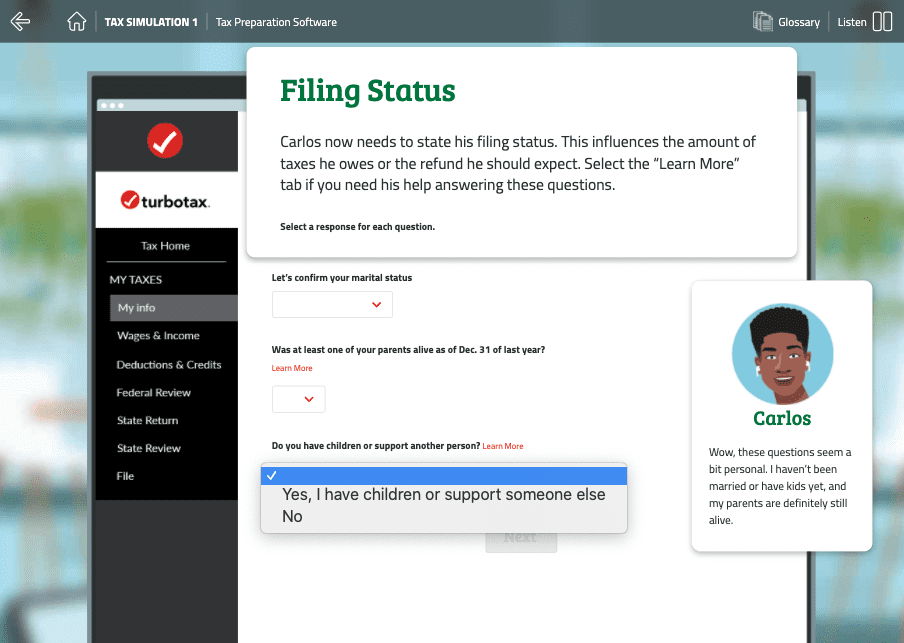

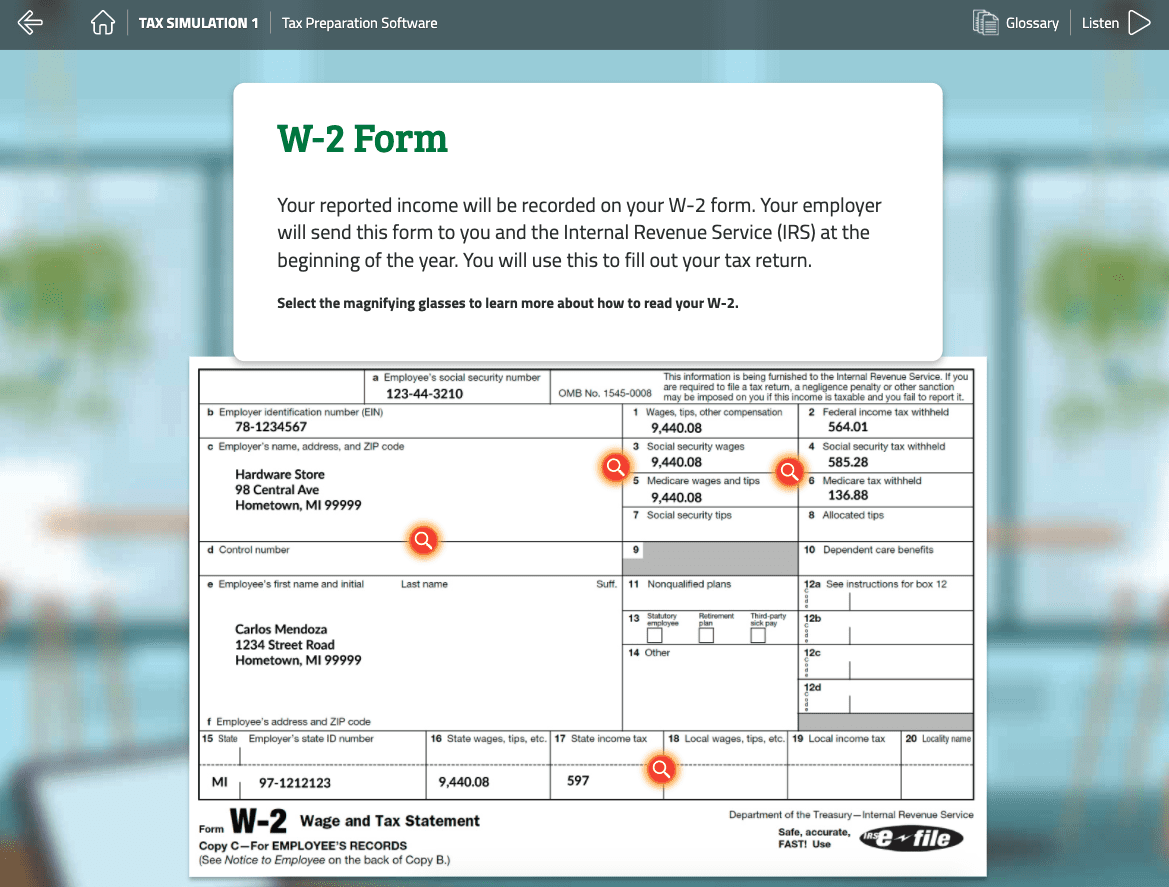

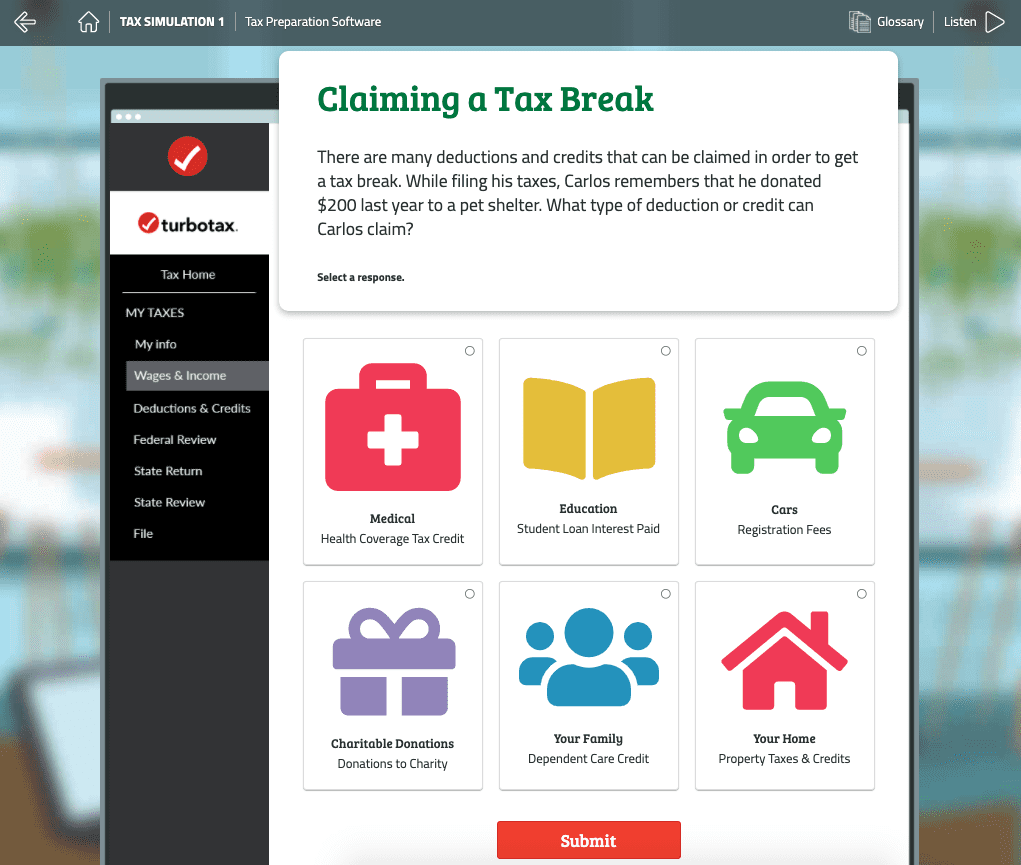

The tax curriculum crafted by EVERFI and Intuit for Education involves interactive exercises and immersive storytelling to prompt students to make financial decisions within simulated scenarios using Intuit TurboTax software. Students navigate these experiences at their own pace, aiding fictional characters in tax preparations and understanding how various life situations influence taxes. From the basics of filing taxes to handling gig economy income and educational expenses, students are exposed to practical tax-related scenarios.

Completing 5 Interactive Lessons in Just 45 Minutes

The tax simulations cover essential skills such as the purpose of tax filing, the impact of different life circumstances on taxes, and the steps involved in tax preparation. The five simulations encompass:

- Filing Your Taxes

- Tax Credits for Families

- Taxes for Gig Workers

- Taxes for Students

- Taxes for Investments

Enhanced Learning Through Quality Resources

The tax simulation developed by EVERFI upholds their reputation for creating immersive digital learning experiences, featuring diverse characters to make personal finance topics relatable to students. Aligned with educational standards and certifications, this simulation mirrors real-world tax scenarios and equips students with valuable skills and knowledge.

Empowering Students for Future Financial Confidence

By engaging in problem-solving activities and scenario-based learning, students develop the necessary skills and confidence to navigate real-life financial challenges outside the classroom. Educators have praised this program for its ability to impart crucial tax knowledge to students in a practical and engaging manner.

Explore the Tax Lessons Today! Discover EVERFI’s Tax Simulation here.