Global Upstream Capex Set To Fall Again In 2026 Amid Low Oil Prices

Wood Mackenzie has predicted that global upstream operators will cut investment for a second consecutive year in 2026, with capital expenditure expected to fall by at least 2-3% year-on-year, and more than 5% compared to 2024 levels, as the industry navigates sub-$60/bbl oil prices while maintaining focus on long-term resilience. Despite this trend, operators are expected to continue adding strategic, new growth opportunities in various regions worldwide.

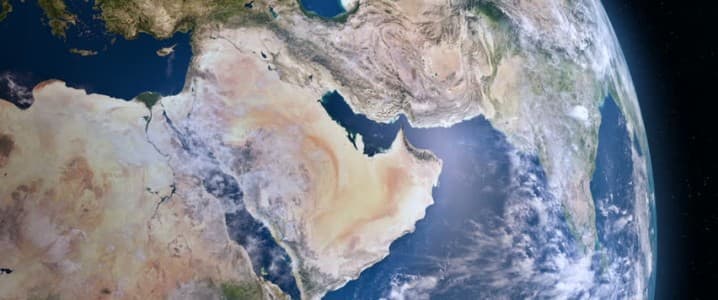

The Middle East and North Africa are poised to add at least 20 billion barrels of oil equivalent through the 2030s through licensing rounds and contract negotiations. One notable development is Libya’s National Oil Corporation (NOC) launching its first oil exploration bid round in over 17 years in March 2025. This initiative aims to boost production and attract foreign investment to reach a production level of 2 million barrels per day (bpd), close to pre-2011 crisis output. This move is seen as a significant step in opening up a resource-rich market to international energy companies.

Additionally, countries like Iraq, Kuwait, Oman, and Syria are offering significant new oil drilling opportunities. Iraq and Oman are planning to build a Basra-to-Duqm pipeline to diversify export routes beyond the Ceyhan pipeline. Kuwait is expanding offshore production with major finds like the Nokhetha discovery, containing estimated reserves of 2.1 billion barrels of light oil and 5.1 trillion cubic feet of gas. ADNOC Drilling is also expanding into Kuwait and Oman by acquiring a 70% stake in SLB’s land drilling rig business.

Syria is actively re-opening for energy investments following the fall of the Assad regime in late 2024. The new Syrian government is pursuing an investment-driven recovery model and has signed billions of dollars in deals with foreign companies. The UAE-based DP World has taken over management of the Tartus port, enhancing logistics for energy trade.

Overall, Middle Eastern nations are actively diversifying beyond Chinese influence, seeking major International Oil Companies (IOCs) for investment in energy and infrastructure. European and American companies are stepping in to capitalize on opportunities in gas, renewables, and digital transformation. The Middle East is leveraging its energy wealth and strategic location to foster a multi-polar partnership model, attracting diverse IOCs to support its ambitious economic diversification and secure new trade routes.

By Alex Kimani for Oilprice.com