-

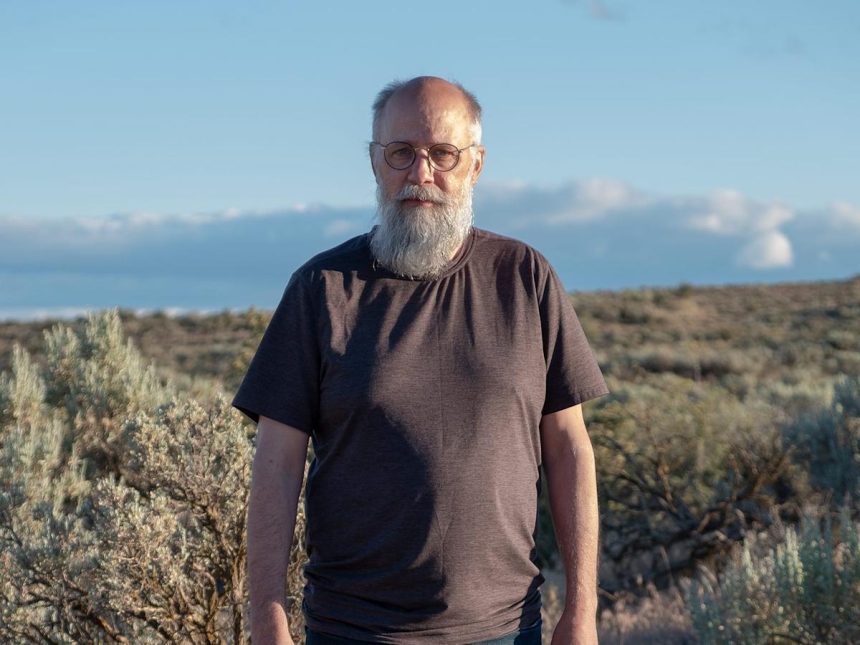

Dan Steven Erickson amassed a retirement fund of $650,000 primarily through his career in education.

-

He also utilized real estate investments and employer-matching retirement contributions to enhance his savings.

-

Despite this financial success, he harbors anxieties about retirement and wishes he had begun investing sooner.

Entering the workforce at 17, I primarily held low-wage positions in restaurants, construction, and convenience stores. I was somewhat of a late starter, beginning college in 1993 at the age of 30.

After earning a bachelor’s and master’s degree in communications, I relocated to Kansas to accept a full-time teaching position at the community college level.

The role included the state retirement program known as KPERs, which featured some employer matching. I contributed a small amount, kickstarting my retirement savings journey.

Following the tragic loss of my firstborn, it became too difficult to remain there. I transitioned to a college position in Indiana, where I also participated in their retirement benefits, including matching contributions. I worked there from 2002 to 2004.

In 2004, I took a position at a college in Washington, where my daughter was born in 2005. I dedicated the next two decades to that institution and left my role in June this year.

In 2019, I sold a property for a profit of about $70,000, which helped eliminate all my student loans, credit card debt, and car payments.

In 2022, I moved to Maine and continued teaching remotely. I purchased another property in Washington in 2021, sold it in 2023, and made a significant profit from that sale.

I acquired a third property in Maine, living there for two years before opting to move to Tennessee for better job opportunities. I struggled to find full-time academic work in Maine.

I now rent the condo in Maine to a relative, covering the mortgage while renting in Tennessee.

About five years ago, I started allocating 7% of my salary to retirement, with my employer matching those contributions. With earnings that allowed for more savings, I invested an additional $200 monthly. My persistence paid off, leading to a growth in my portfolio.

By the age of 59, my retirement accounts reached $500,000. Additionally, I inherited $70,000 from my mother after her passing in 2022. Considering my savings, that amounted to nearly $100,000 more for my retirement. I have roughly $100,000 in equity through real estate, bringing my total nest egg to about $650,000 so far.

Throughout my retirement journey, I’ve held numerous positions, including with the Postal Service, which I left due to low pay for extensive hours. Currently, I work part-time at Cabela’s, in addition to part-time teaching.