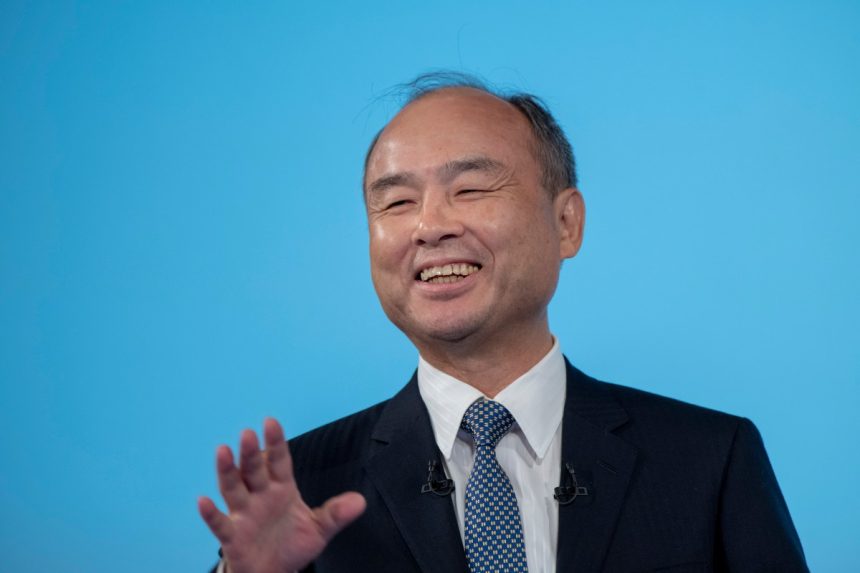

Masayoshi Son’s Bold Move: Selling NVIDIA Stake to Double Down on AI

Known for his daring bets and fearless attitude, Masayoshi Son, the founder of SoftBank, has once again surprised the business world with his latest move. Son has decided to cash out his entire $5.8 billion stake in Nvidia to go all-in on artificial intelligence (AI). While this decision may have caught many off guard, it is in line with Son’s history of making audacious moves.

Throughout his career, Son has made headlines with his risky investments. One of the most notable examples is his bet on Alibaba during the late 1990s dot-com bubble. Despite facing a massive financial loss during the dot-com implosion, Son’s $20 million investment in Alibaba in 2000 turned into a $150 billion windfall by 2020, solidifying his reputation as a visionary investor.

However, not all of Son’s bets have paid off. The ill-fated investment in Uber and the disastrous WeWork saga are reminders of the risks involved in Son’s high-stakes gambling. The WeWork debacle, in particular, cost SoftBank billions in equity and debt, tarnishing Son’s legacy.

Join us at the upcoming Techcrunch event in San Francisco on October 13-15, 2026

Despite these setbacks, Son is determined to make a comeback. His decision to sell off the Nvidia stake and focus on AI demonstrates his unwavering commitment to pushing the boundaries of technology. SoftBank’s planned $30 billion investment in OpenAI and participation in a $1 trillion AI manufacturing hub in Arizona highlights Son’s ambition to lead the charge in the AI revolution.

While the market may be rattled by Son’s bold move, analysts believe that it reflects SoftBank’s strategic shift towards AI rather than a lack of faith in Nvidia. Son’s track record of visionary investments leaves investors wondering if he sees something that others do not. Only time will tell if Son’s gamble on AI will pay off, but one thing is certain – Masayoshi Son is not one to shy away from taking risks.